Despite a downturn in supply chain investment intentions, there are promising signs of growth which demonstrate a clear economic opportunity in UK manufacturing.

- Manufacturers are running close to current capacity levels, with 91% of BEAMA members without reserved capacity for demand fluctuations. This means decisions need to be taken now to increase capacity for 2030 infrastructure delivery and beyond.

- Today, BEAMA launches its #AcceleratingElectrication campaign, backed by 200+ members, aimed at fostering sustainable growth and investment within the UK electrical supply chain.

- BEAMA members call for greater visibility of transmission and distribution network expenditure beyond 2030.

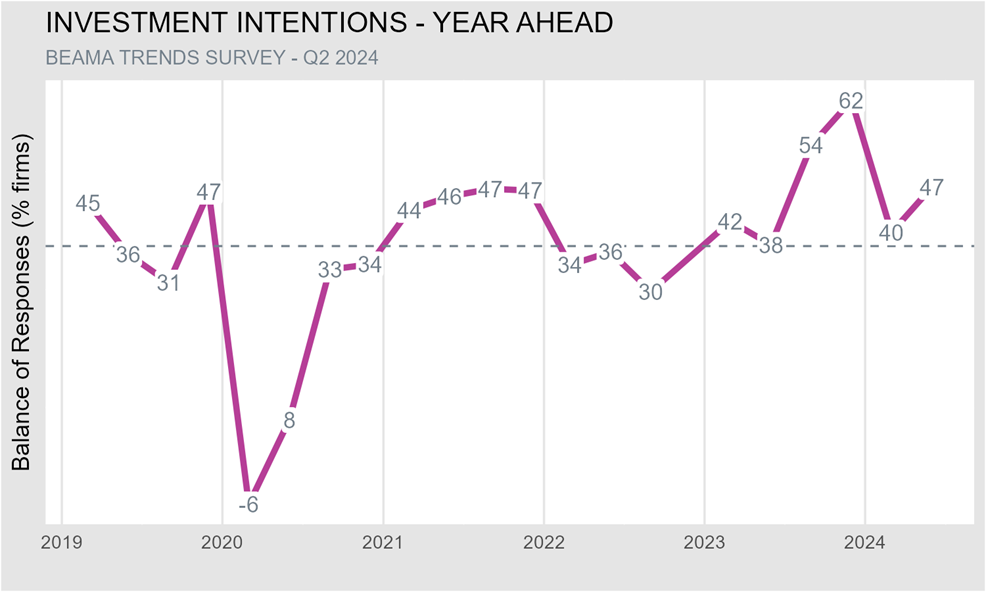

LONDON, Monday 16th September: BEAMA, the trade body for energy infrastructure and systems, representing a sector currently worth £14 billion, has today launched its first Market Pulse quarterly report to kickstart its #AcceleratingElectrification campaign. The new analysis reveals that while the supply chain is poised to deliver the significant increase in demand for low carbon heating and electric vehicles, investment intensions are still significantly lower than 12 months ago and fall short of the UK’s electrification needs.

Source: BEAMA Trends survey

The slower uptake of Net Zero technologies, knocked by repeated policy delays and U-turns, has resulted in the UK attractiveness for investment being called into question. Despite this, the UK’s Net Zero supply chain is optimistic and poised to deliver as evidenced by significant UK manufacturing investments by BEAMA members earlier this year.

#AcceleratingElectrification is an industry wide campaign, backed by BEAMA’s 200+ members, which seeks to foster sustainable growth and investment within the UK electrical supply chain. Growing the UK’s electrical supply chain is a prerequisite to delivering Labour’s Clean Power by 2030 target, providing the essential components for decarbonising the nation’s energy, heat and transport infrastructure. Strong and ambitious Government targets are welcome, but a more detailed roadmap and decisive action is required today to deliver the supply chain requirements of tomorrow.

UK faces critical timing mismatch in reaching decarbonisation efforts

While politicians focus on immediate policy requirements and the networks operate within five-year price controls, supply chains require five–seven-year horizons to plan manufacturing capacity and supply a competitive global market for low carbon technologies. When a new factory can take seven years to build, or a skills shortage impedes capacity to deploy products, clear policy and regulatory signals that translate into manufacturing orders are needed to address this gap and stimulate this critical £14bn sector.

BEAMA members are spread across the whole of the UK’s electrification value chain and there is a clear divergence where electricity networks investment has seen a clearer picture for investment. However, this is still considered too short term and there needs to be greater visibility of transmission and distribution network expenditure beyond 2030.

Yselkla Farmer, BEAMA CEO, said: “The UK is clearly back in the global race for Net Zero delivery, and with a series of imminent policies that will accelerate electrification across power, heating and transport there are reasons for optimism. However, a gap continues to grow between the projected energy sector investment needed to meet our targets and the current rate of deployment.

Optimism and confidence are far from where they need to be, and without urgent clarity, UK manufacturing of these vital technologies will struggle to meet future demand. The choice is clear, risk becoming reliant on supply chains outside of the UK or capitalise on the huge potential to grow this economic opportunity and build on the current £5bn of exports we currently maintain.”

BEAMA’s surveys show that the industry intends to invest, but that the extent of this is not yet transformational, or aligned with projected demand, capacity is not being maximised and optimism remains cautious. Concerted measures to accelerate electrification still have time to make significant improvements before 2030, but only if we understand the current trajectory and act quickly to improve it.

Key findings of the report indicate the UK is missing its decarbonisation targets and lacking the clear frameworks and detailed roadmaps to increase the pace at scale:

- Modest increase in investment intentions across the sector does not reflect electrification needs for the UK. Far greater certainty of demand is required, either from government-led investment at infrastructure level or from builders and consumers for end-use products.

- Supply chain capacity utilisation edged lower below five-year average, while some parts of the supply chain for electricity networks report operating at full capacity. 91% of members do not reserve capacity for demand fluctuations which means decisions need to be taken now to increase capacity for 2030 infrastructure delivery and beyond.

- Manufacturing unit costs hit a four-year low with energy, shipping and labour costs having a greater impact than materials, underscoring that now is a prime moment to invest in UK manufacturing.

- 50% of BEAMA members report an intention to hire more employees, but challenges in filling vacancies remain because of ongoing engineering and STEM skills shortages.

- UK needs to increase heat pump uptake up by 16 times[1] current delivery rates to hit 2030 targets. We can fill the spark gap through electricity price rebalancing and opening the market to the full range of electric heating products as well as heat pumps.

- UK is 11 years away from having a complete smart metering system[2] to support a smart flexible energy system in the UK. This will not enable us to meet our Net Zero targets. Manufacturers are leaving the UK market due to slowdown in smart meter deployment.

- Innovators operating in heat electrification are struggling to commercialise at scale due to slow progress with policy support and uncertainty over the construction sector outlook. Narrow focus on certain heat technologies is impacting the ability to scale up (progress towards the heat pump lead forecast is only at 10%) and therefore risking an inability to address the 20% non-heat pump homes identified by Government – this represents 6m units and immediate action is required.

Capitalising on the global market opportunity

Whilst there have been significant delays, there is a huge global opportunity[3] to position the UK as the global Net Zero workshop. Market Pulse data reveals that business optimism has bounced back to above the five-year average in 2024. In the last month alone, BEAMA members have committed to investing in the UK, with Schneider Electric investing £42m in a new manufacturing site, bringing 200 green jobs to North Yorkshire and Wilson Power Solutions has been acquiring sites in the UK for further factory expansion.

Kelly Becker, president at Schneider Electric, UK & Ireland, Belgium & Netherlands said:

“This milestone investment in our new Scarborough factory demonstrates Schneider Electric's unwavering commitment to the UK market and support for the nation’s decarbonisation journey through the development of innovative solutions and the creation of local, green jobs. As we continue to expand our presence, we look forward to collaborating with BEAMA and the UK government to place accelerating electrification at the forefront of UK policy.”

Erika Wilson CEO of Wilson Power Solutions Ltd commented: “The UK is world-leading in its Net Zero commitment and specifically energy decarbonisation, making it a lucrative environment to do business. We have seen consistent uplift in demand from our customers and so have recently increased our footprint in the UK by acquiring another site for further factory expansion. However, compared to other markets, the future is unclear. We are still lacking the certainty and clear market drivers for electrification which will incentivise manufacturers to engage and commit to this market. Alongside our BEAMA supply chain partners, we are committed to working closely with the new Labour Government to develop a plan that gives clarity to the supply chain to be confident to invest in their facilities and people to support the path to New Zero.”

The road ahead

BEAMA has formed the Electricity Products Supply Chain Council, a body made up of all key industry organisations, focused on improving investment and delivery conditions for boosting the Net Zero economy. The Council is eager to spark action and deliver the essential building blocks to secure the UK’s future decarbonisation. BEAMA calls on government to ensure this has ministerial leadership to spearhead regular dialogues between the supply chain, infrastructure providers and the construction industry.

- Key Council priorities will be:

- Investment in electricity networks – continue and expand collaboration to improve visibility of future work to improve investment conditions.

- Active monitoring of deliverability – reviewing market trends and product supply issues and proposing interventions to resolve these.

- Assessing supply chains for electrification technologies – analysing deliverability of buildings decarbonisation targets and opportunities for UK industry.

ENDS

Notes to Editor

Market Pulse data

The quarterly Market Pulse report tracks progress on the delivery of the UK’s 2030 and 2050 target, seeking to bridge the gap between projected supply chain delivery and actual figures spotlighting the UK’s journey to drive investment into the manufacturing supply chain. BEAMA has been analysing trends in the UK market closely for over 2 decades and conducts quarterly trends surveys with BEAMA members (approx. 200 companies).

About BEAMA

BEAMA is the leading UK trade association for manufacturers and providers of energy infrastructure and systems. BEAMA represents a sector currently worth £14 billion, employing 90,000, with exports worth £5 billion. BEAMA exists to support its members in ensuring that the UK has a strong electrotechnical industry which is recognised as an essential part of modern society and brings invaluable economic, social and environmental benefits. It represents directly some 200 companies in the UK electrotechnical and allied manufacturing industries advising its members on relevant technology and market developments, particularly relating to the areas of product safety and sustainability.

Media contacts

Annabelle Duke, Instinctif Partners, [email protected]

[1] Source: HPA/ OFGEM (FES forecast)

[2] Source: DESNZ

[3] Source: McKinsey Powering Up Britain: Net Zero Growth Plan - GOV.UK (www.gov.uk)